As we move toward the end of election season, tax talk is bound to continue being a hot topic of discussion. Wondering about what tax code changes our next president may try to enact could even carry us right into tax season. And yes, tax season really is approaching that quickly.

That means now is the time to start thinking about your tax picture and trying to position your finances so that you do not get hit with a surprisingly large tax bill. This could be a disconcerting idea for those already experiencing some financial losses. Some of those losses, though, could come with tax benefits of their own, including those on rental properties.

This type of loss is not rare, especially when someone first becomes a landlord. I have seen IRS statistics that say half of people reporting rental income show a loss. The rules around how much of this can be deducted, however, can get complicated.

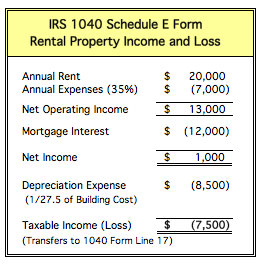

First, to break down just what a rental loss is without any real numbers, it is very much what it sounds like – if the operating expenses exceed the rent collected, there is a loss. There can also be a loss if the money collected exceeds the expenses due to depreciating a portion of the cost of the property.

These losses do not become clear deductions because they are considered to have happened because of a passive activity. The IRS defines these activities as follows:

Passive activities include trade or business activities in which you do not materially participate. You materially participate in an activity if you are involved in the operation of the activity on a regular, continuous, and substantial basis. In general, rental activities, including rental real estate activities, are also passive activities even if you do materially participate.

Passive losses then can only be used as deductions to passive income. You cannot simply take the money you made from a full-time job and then deduct your rental losses from it.

This rule does not apply if you or your spouse are real-estate professionals (not necessarily the same as real estate agent). It is also possible that you can deduct $25,000 from your non-passive income if your adjusted gross income is less than $100,000 and you have actively participated in rental activities.

And you thought the differences between being active and passive was just for verbs and the treadmill…

Active participation in this case means you are involved in management decisions concerning the property and have more than a 10% ownership in it. The allowance is gradually phased out between $100,000 and $150,000 of your modified adjusted gross income, above which it is eliminated entirely.

That means this move is no good for landlords with high other-than-rental income, unless that landlord is one of those previously mentioned real estate professionals, where the rule does not apply. Being classified as a real estate professional generally means spending at least 751 hours a year on rental property management and related activities.

If none of these situations apply to you, those passive losses can still be suspended and deducted in a future year when there is enough passive income to do so, or when you sell the property.

There are other solutions to the rental loss issue. If you are interested in having your situation thoroughly analyzed, please be sure to contact us at once.

All this does get complicated, as most IRS rules do. As always, though, we are happy to help you find your way through their difficult nature. This is what we love to do, after all.